Production Linked Incentive (PLI) For Toy Production

According to sources, India is set to get a big push with the government actively considering the extension of the Production Linked Incentive (PLI) scheme to the sector with a proposed outlay of about ₹3,500 crores.

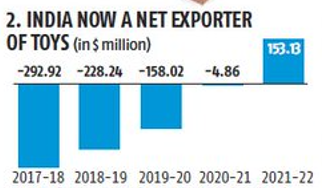

Transformation in India’s $1 billion toy industry. India’s toy imports, essentially from China, have fallen by 70 percent in the last three years from $371 million in 2018-19 to $110 million in 2021-22, while exports have risen 61.4 percent in the same period, from $202 million to $326 million. The industry has turned into a net foreign exchange earner since 2020, after being a net importer to the tune of $150-200 million or more in the three or four years that preceded it.

To encourage more micro, small, and medium enterprises (MSMEs) to take advantage of the scheme, the investment slab could be kept as low as Rs 5 crore. However, the incentives will be for toy making and not on toy components.

Although India’s share in the world toy trade has marginally improved, it still lags behind China’s . Toys are not China’s main item of export, but about two-third of the toys sold globally are from China. The world exported toys worth $73.2 billion in 2021: China accounted for 66.2 percent or $48.4 billion of that, out of which mainland China made up $46.1 billion and Hong Kong $2.4 billion.

By comparison, India’s toy export was minuscule 0.23 percent of the world’s toy exports.

However, in a major boost for the country’s domestic manufacturing capacity, India is likely to extend the production-linked incentive (PLI) scheme to domestic toy manufacturer after Chinese toyes were found to be unsafe. A government survey in 2019 reported that about 70 percent of all the toys imported from China failed the country’s safety test. India currently has a PLI scheme in 14 sectors and it has committed a total financial outlay of INR 1.97 trillion.

According to industry experts, the scheme has thee potential to add 4 percent to India’s gross domestic product per annum by boosting the country’s manufacturing capacity.

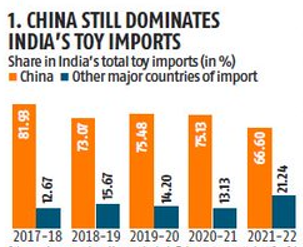

China is the largest supplier of toys in India. An analysis found that toys imports from China have reduced to five year from FY18 to FT22. India still imports about three-fifth of its toys from the country. In FY18, Chinese toy imports made up four-fifth of all toy imports into India. However, in FY22, Imports from Taiwan, Japan, Italy, the US, Sri Lanka, Germany, UK and the UAE accounted for more than a fifth of India’s toy imports (See chart 1)

India has consistently reduced its toy imports over the past five years and is now a net exporter of all kinds of toys, which include sports equipment, dolls, fishing equipment, games, festive and carnival items, circus, and amusement items, among others. In FY22, the trade surplus in toys stood at $153 million against the trade deficit of $ 292 million five years ago (See chart 2)

The analysis also found that the steepest reduction between FY18 and FY22 has been in the import of dolls; scooters, pedal cars, and wheeled toys, and article for circus and traveling menageries. However, the import of sporting articles and fishing equipment have risen by 24 percent and 110 per -cent respectively.

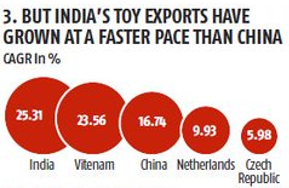

The gap is still huge but India’s toy export is growing at a faster pace than China’s. Indian toy exports have grown at a compound annual growth rate of 25.3 percent between 2012 and 2021 compared to 23.5 percent for Vietnam and 16.7 percent for China (See Chart 3).

In 2021, China’s export exceeded India’s export 279 times and Vietnam’s export exceeded India’s eight times.

Great move by introducing BIS certification mandatory for Toys.

The government policy on increasing customs duty on imported toys and making BIS certification mandatory for toys has boosted domestic toy manufacturing.

The move by the government has also helped the industry to explore global markets enhancing exports.

The Indian toy market is growing at over 12 percent. Three years ago, nearly 80 percent of the toys were imported, but, today, the scenario changed as imports dropped dramatically.

Citing data provided by the Ministry of Commerce and Industry, imports of toys which stood at USD 304 million in 2018-19 fell to USD 36 million in 2021-22.

Over four to five lakh artisans were involved in the making of toys and nearly 75 per cent of the toy-manufacturing facilities comprise micro, small and medium enterprises.

In case of queries, drop us a line on communications@ndm.net.in

Have Any Question?

Send us a message and tell us more about your business and financial goals. We will get back to you soon to schedule a consultation.

- +91 9873210394

- Communications@ndm.net.in