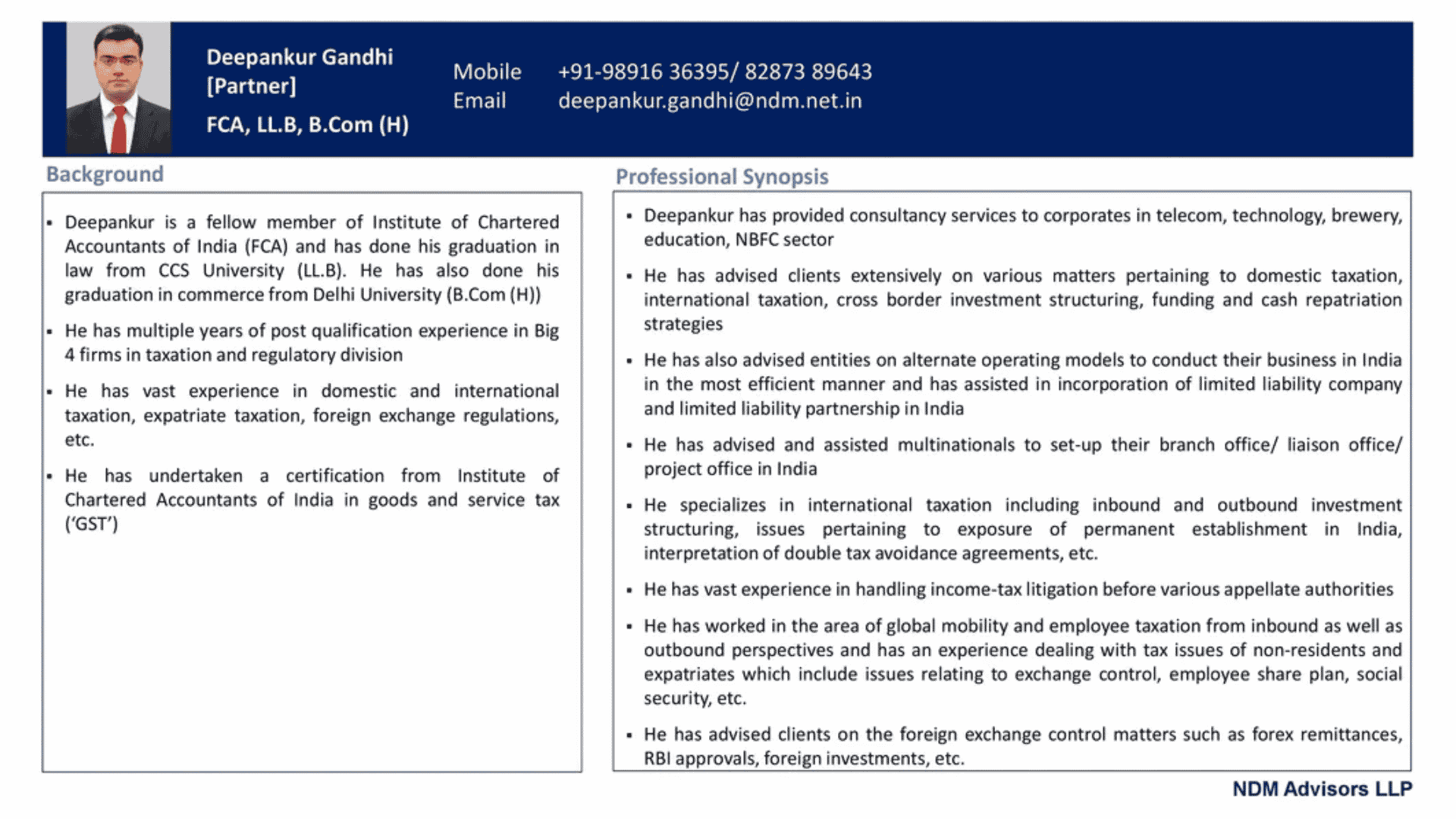

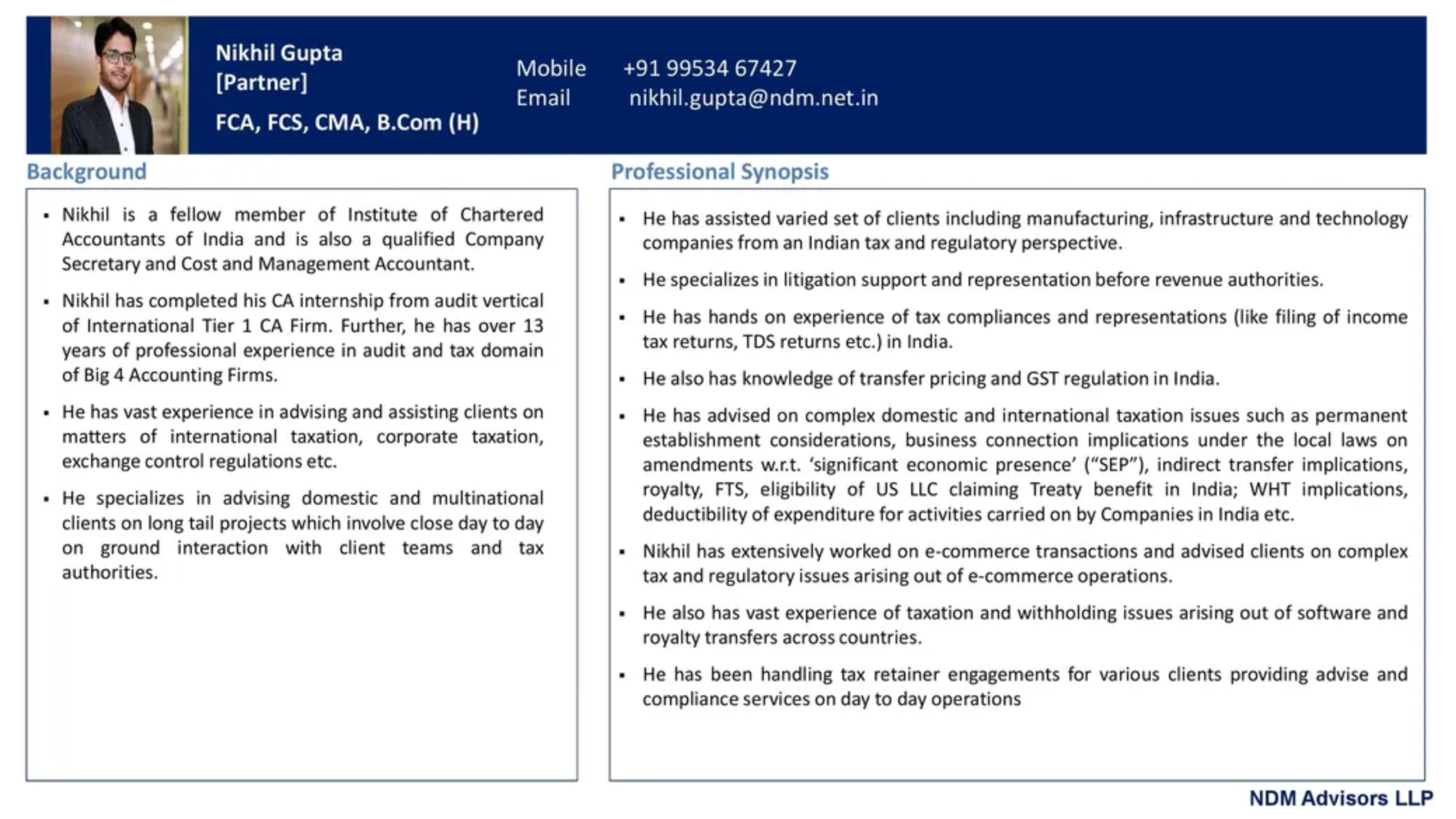

Expatriate Advisory Services

Indian Expatriate Advisory

With increased movement of capital, goods and services across various countries, increasing number of global organisations are deploying workforce across borders and geographies. Cross border movement of workforce poses such organisations with challenges of compliances for both, home and host countries. NDM’s Expatriate Services practice provides unique solutions to tax and regulatory issues faced by organisations while managing statutory compliances in respect of their globally mobile employees.

- FRRO and Visa Norms

- Employment Agreement

- Social Security and Taxation Advisory

- Payroll and Withholding Taxes

- India Exit Clearances

FRRO and Visa Norms

Foreign Regional Registration Office (‘FRRO’)

- All Expatriate employees coming to India are mandatorily required to get registered with jurisdictional FRRO office;

- FRRO procedures are required to be completed within specified timelines and requisite documents are required to be furnished to the authorities;

- All expatriates staying in India must hold valid FRRO Certificate all the time;

- FRRO certificate is required to be renewed periodically upon its expiration;

VISA Norms

- Expatriates coming to India must possess proper visa depending on their contract with the employer company;

- Such employer company acts as ‘sponsor’ and is required to furnish adequate documents while applying for Visa;

- Validity of Visa is specified and requires renewal at before the same expires;

Employment Agreement

Employment Agreement

- All Expatriates are required to have a proper employment/ deputation agreement for their tenure in India;

- Such agreements have implication on the overseas and Indian company’s tax position;

- Proper planning and execution of the agreement is required to be done in order to have optimum tax benefits in India and abroad;

- Planning is also required to be done for the bank account in which the salary and other perquisites are required to be disbursed to the expatriate employees;

- Employer entity, salary/ perquisites, designation, tenure, termination etc. are some of the considerations which go into preparation of the employment agreements.

Permanent Account Number (PAN)

- All the expatriate employees are required to have Permanent Account in India and the same must be immediately applied for as soon as they enter India;

- PAN also acts as a national ID proof for expatriate employees;

Bank Account

- Depending on the bank account in which the disbursements would be made for the expatriate employees, Indian employer would also be required to get bank account opened for the Expatriate employees.

Social Security and Taxation Advisory

India Social Security and Taxation

- Expatriate employees are required to comply with the Indian Social Security and Taxation compliances;

- Social Security and Taxation related deductions are required to be done by the employers at the time of payroll processing;

- Social Security and taxation identification numbers are also required to be obtained for all the Expatriate employees;

Foreign Social Security and Taxation Credits

- Expatriate Employees generally qualify as ‘international workers’ under the Indian Social Security norms and do get certain benefits on the social security contributions required to be done in India;

- Under the ‘Double Taxation Avoidance Agreements’, Expatriate employees are eligible to claim credit for the taxes paid outside India depending on their tax residential status in India and overseas;

- Careful planning is required to be done by the employer at the initiation of the employment tenure so as to maximise the benefits and avoid any non compliances;

Payroll and Withholding Taxes

Payroll Processing

- Payroll of an Expatriate employee should be carefully planned in order to optimise the tax and other allied benefits;

- Payroll is required to be run on a monthly basis in order to determine the monthly amount payable to an Expatriate employee after deduction of statutory withholdings;

Withholding

- As explained in ensuing slides, monthly withholding is required to be done by the employer from payroll of Expatriate employees for following:

a)Indian Taxes Deducted at Source (TDS); and

b)Indian Provident Fund (PF) contribution

- Withholding calculations are required to be run each month in order to determine exact amount of deductions for each Expatriate employee

- While updating the monthly withholding calculations, credits are required to be done for foreign social security and tax related withholdings.

India Exit Clearances

Exit Clearances

- While exiting India, every Expatriate must ensure that the compliances pertaining to withholding taxes, income tax return, social security etc. are completed;

- Before leaving India, all expatriate employees are required to obtain No Objection Certificate (NOC) from the Indian revenue department;

- On part of employer, it must be ensured that the Indian bank account, PAN surrender, withholding dues, income tax return and other allied compliances are duly completed for each of the Expatriate employee before they leave India.

Related Posts

Have Any Question?

Send us a message and tell us more about your business and financial goals. We will get back to you soon to schedule a consultation.