Company Incorporation

FREE Expert Consultation

About NDM Advisors LLP

- NDM Advisors LLP is a multidisciplinary professional services firm consisting of experienced Chartered Accountants, Certified Public Accountants, Lawyers, Company Secretaries and Cost Accountants catering to diverse needs of businesses

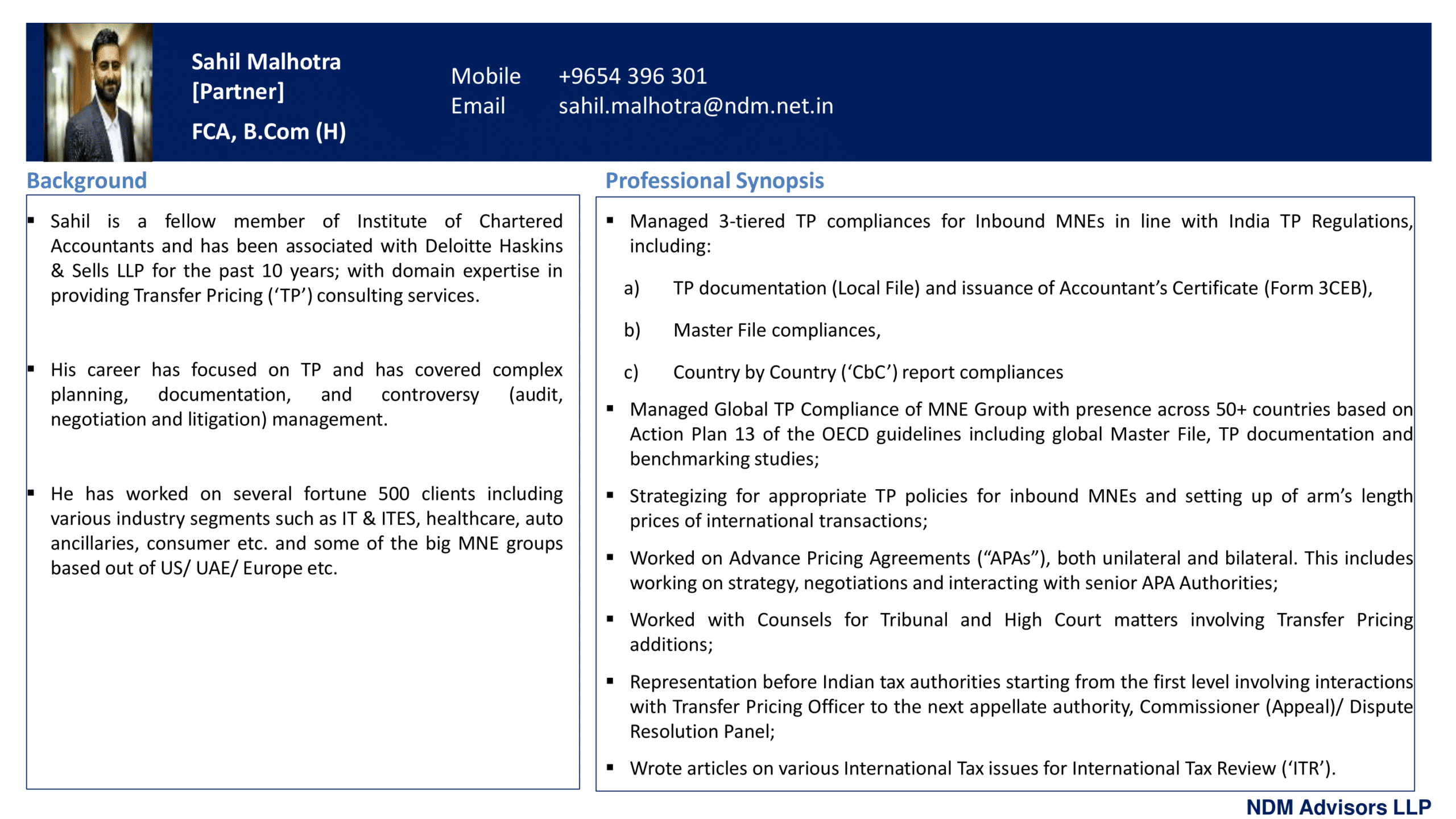

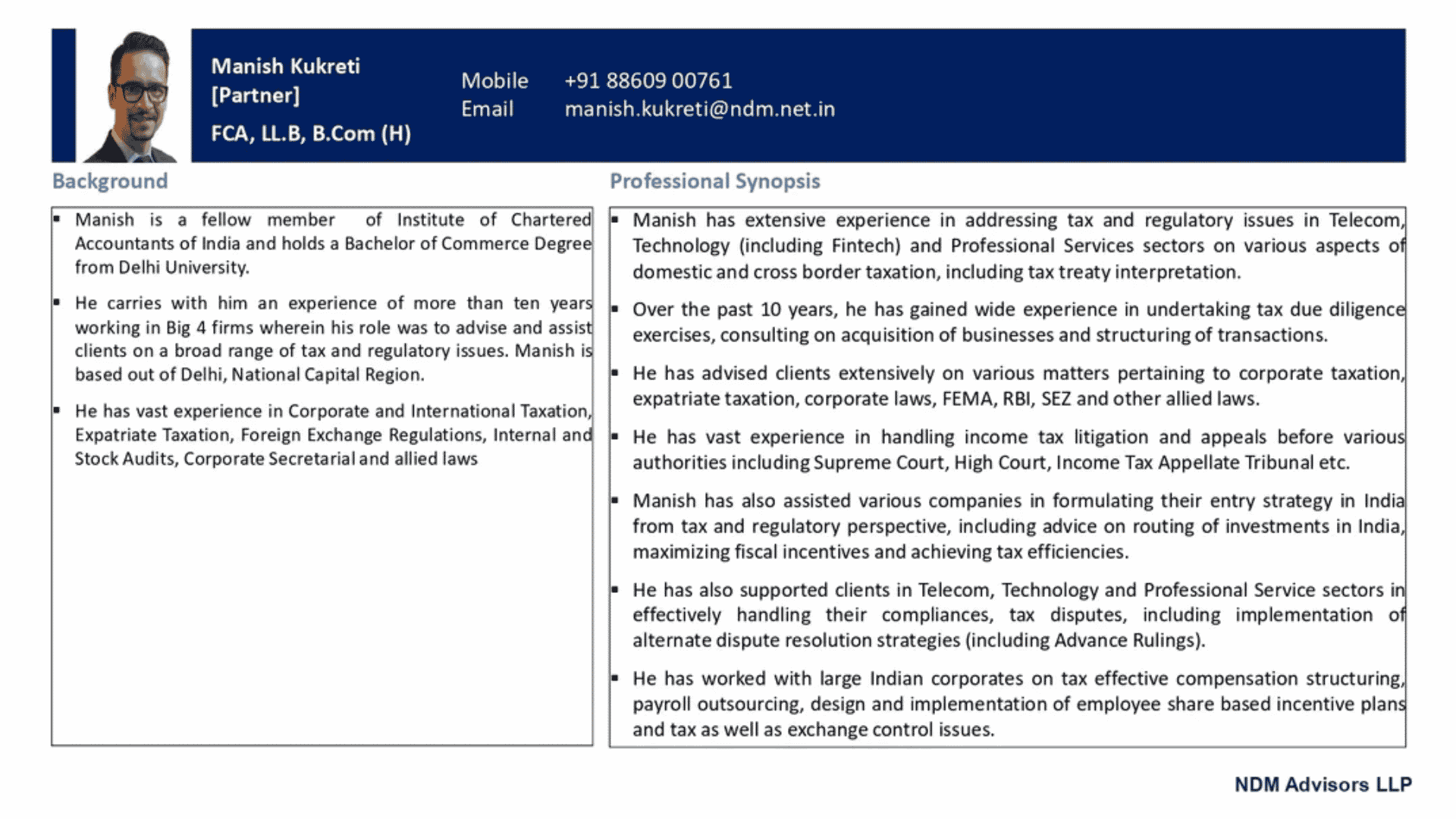

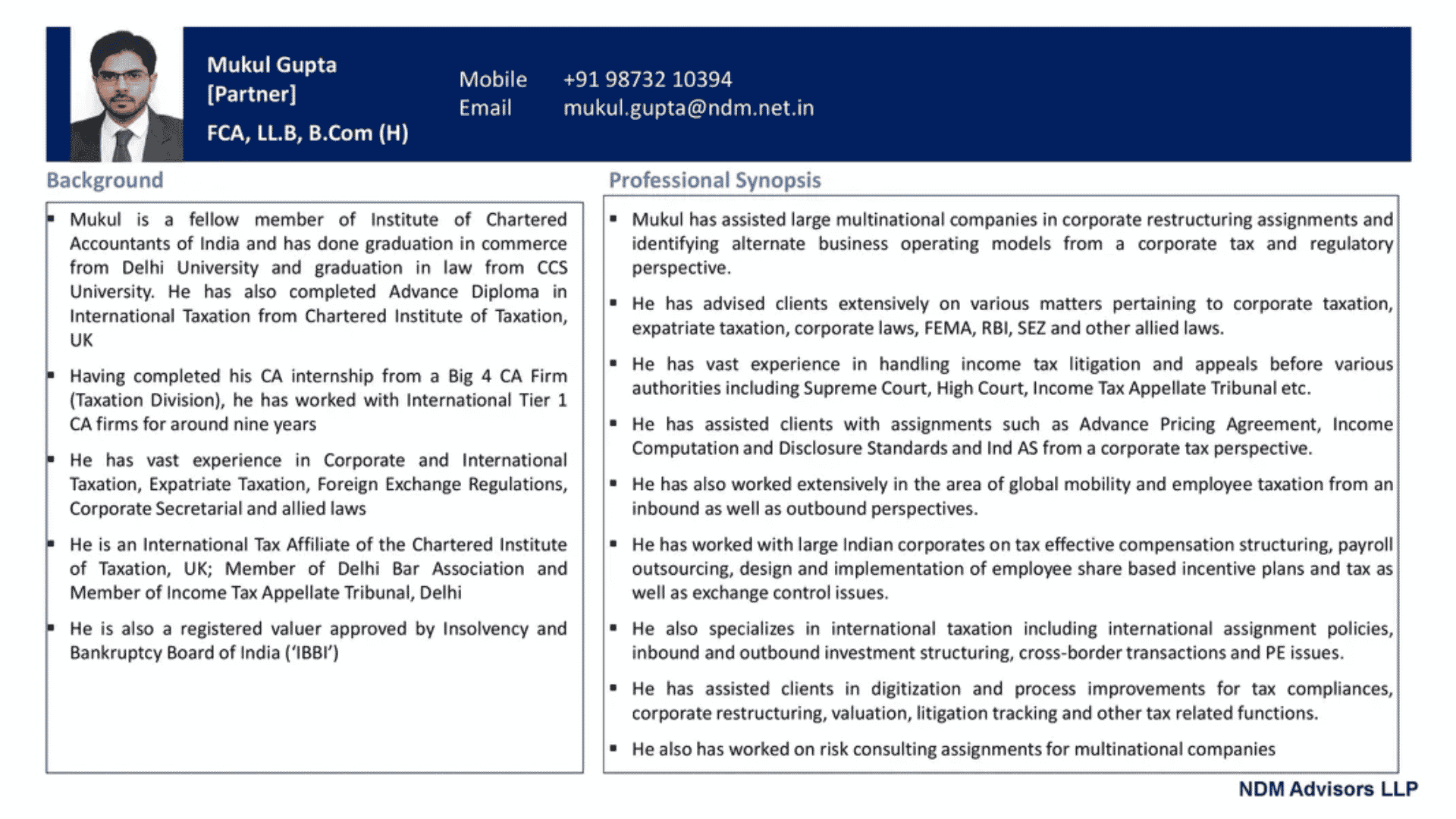

- NDM is headed by partners having wide experience in working with the Big Four consulting firms (KPMG, EY, Deloitte and PwC) in areas of Finance, Audit & Assurance, International Taxation, Transfer Pricing, Foreign Regulatory, Corporate Laws, Auditing, etc.

- Our partners have been advising large domestic and international corporates on some of the most intricate and complex fixed asset and inventory management issues and solutions

- NDM has been knowledge partner at events and seminars organised by ICAI, Income Tax Department and other organisations. Partners of NDM actively participate as speakers at various events and conferences

- NDM’s objective is to collaborate with clients and support them in their business development

- At NDM, we aim to be the best at all that what we do. It is this passion for perfection that fuels us and makes us truly different

Entity Types in India

- Generally, five types of entities can be formed in India in order to carry on the business activities. These are Sole Proprietorship, Partnership, One Person Company, Company (Private or Public) and Limited Liability Partnership (‘LLP’)

- Sole Proprietorship and Partnership carries with unlimited liability and hence, are not advisable from a long term business perspective;

- For One Person Company, the person incorporating the company should be resident of India and hence, this also does not suit long term business requirements;

- Hence, for the large players, Company and LLP are most feasible options. We have provided below, few pertinent characteristics for both options.

Entity Types in India- Pertinent Features

Particulars | Private Company | LLP |

Law Applicable | Companies Act , 2013 | Limited Liability Partnership Act, 2008 |

Minimum Share Capital / Contribution | There is no minimum share capital requirement | There is no minimum capital contribution requirement |

Number of Directors/ Partners | It requires minimum 2 members as directors and maximum 200 members. It is mandatory to have a minimum one India resident Director | It requires minimum 2 members as partners and there is no limit on the maximum no of partners. It is mandatory to have a minimum one India resident partner |

Board Meeting | Mandatory required to hold 4 board meeting in each calendar year | There is no mandatory requirement to hold board meetings |

Foreign Direct Investment (FDI) | It is eligible to received FDI under Automatic and Government Route | It is eligible to received FDI under Automatic Route |

Compliance | High | Low |

Statutory Audit | It is mandatory to have statutory audit under Companies Act, 2013 | Would apply only if partner’s contribution exceeds INR 25 lakhs or annual turnover exceeds INR 40 lakhs |

Entity Types in India- Tax Consideration

Particulars | Private Company | LLP |

Base Tax Rate | 22% | 30% |

Surcharge (levied on tax amount) | 10% | 12% – Income > INR 10 Million |

Cess (levied on base tax and surcharge) | 4% | 4% |

Tax treatment of upward movement/repatriation of profits (distributed as dividends) (Pleas refer following slide) | Taxable in the hands of shareholder (20% plus applicable surcharge and cess or rate as per tax treaty, whichever is beneficial) | Tax exempt |

Entity Types in India- Tax Consideration

Profit Repatriation – Illustration

Particulars | Private Company | LLP |

Profit before tax | 100 | 100 |

Less: Tax | 25.17 | 30 |

Profit available for distribution to investors | 74.83 | 70 |

Less: Taxes on pay-out of profits @ 20.56% (in the hands of shareholders) | 15.39 | – |

Profits distributed | 59.44 | 70 |

Total Tax Outflow | 40.558 | 30 |

Based on the analysis under the previous slides, it can be seen that as compared to a Private Company, a LLP enjoys the following key benefits:

- Exemption of profit share in the hands of the partners

- Tax free exit in case of non-resident shareholders can be explored

- Relatively less corporate law compliances under the LLP Act as compared to Companies Act 2013.

SCOPE OF SERVICES

1.Incorporation of Entity in India

Every company/ LLP in India is required to be registered with Ministry of Corporate Affairs (‘MCA’) under the provisions of The Companies (Incorporation) Rules, 2014 and The Companies Act, 2013 or Limited Liability Partnership Act, 2008. In this regard, we provide end to end assistance in incorporation of the proposed Indian entity along with the allied secretarial compliances with the following:

- Obtaining Digital Signature Certificates for signatories in India (Proposed Shareholders/ Partners and Directors);

- Assistance with name approval procedures and application (E-web Form);

- Assistance with preparation and filing of company incorporation forms (E-web Forms);

- Applying for taxpayer’s registration number- Permanent Account Number (‘PAN’), Tax Deductor’s Account Number (‘TAN’), GST (‘Goods and Services Tax’) Identification Number, Bank Account Opening Form;

- Preliminary secretarial compliances such as holding of mandatory initial board meeting, share certificate issuance, auditor appointment etc.;

- Secretarial filings pertaining to increase in Authorised Share Capital (if any).

2.Directorship Services

The newly set-up entity would be in need of a qualified professional to act as its director and signatory in India for various purposes (on instructions of the overseas counter-part). In this regard, we would provide the entity with qualified professional acting as director / signatory of the Company for the following purposes:

- Indian Director/ Partner as per mandatory government regulations;

- Signatory for the purposes of Indian regulatory filings/ compliances;

3.Registered Indian Address Services

The Entity would be in need of registered office address for establishing its India presence. In this regard, we would provide the Entity with registered office address for the following purposes:

- Providing Indian correspondence address (New Delhi, India);

- Coordination / handling correspondence related to business with the government/ non-government agencies;

4.Post-Incorporation Compliances

After incorporation, the Entity would be requiring services pertaining to the day-to-day compliances depending upon the scale of operations and applicability of compliances. We offer full range of services to assist the newly set-up entities with following compliances:

- Goods and Services Tax (GST) compliances;

- Withholding tax compliances;

- Corporate Secretarial compliances;

- Accounting Services;

- Corporate Income Tax Return and allied tax filings;

- Statutory Audit Support;

- Employee Payroll and HR Services;

- Expatriate Tax Compliances.