Gallery

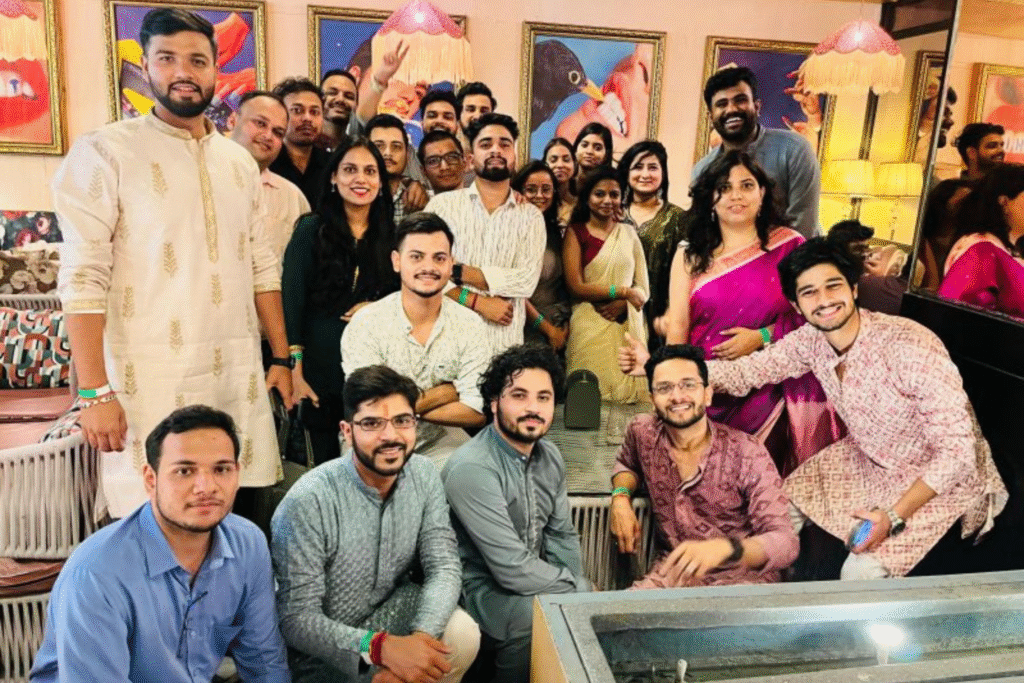

🎉 𝗡𝗲𝘄 𝗬𝗲𝗮𝗿 𝗖𝗲𝗹𝗲𝗯𝗿𝗮𝘁𝗶𝗼𝗻 𝟮𝟬𝟮𝟲 🎉

As we step into the New Year, we do so with renewed motivation, fresh goals, and a strong commitment to excellence and impact. We remain focused on delivering practical, value-driven solutions that help businesses grow, stay compliant, and navigate change with confidence. We are grateful to our team members, leadership, clients, and partners for their continued trust and support.

Here’s to embracing new challenges, creating meaningful impact for our clients and businesses, and achieving new milestones together in 2026. ✨

Wishing everyone a happy, healthy, and successful New Year!

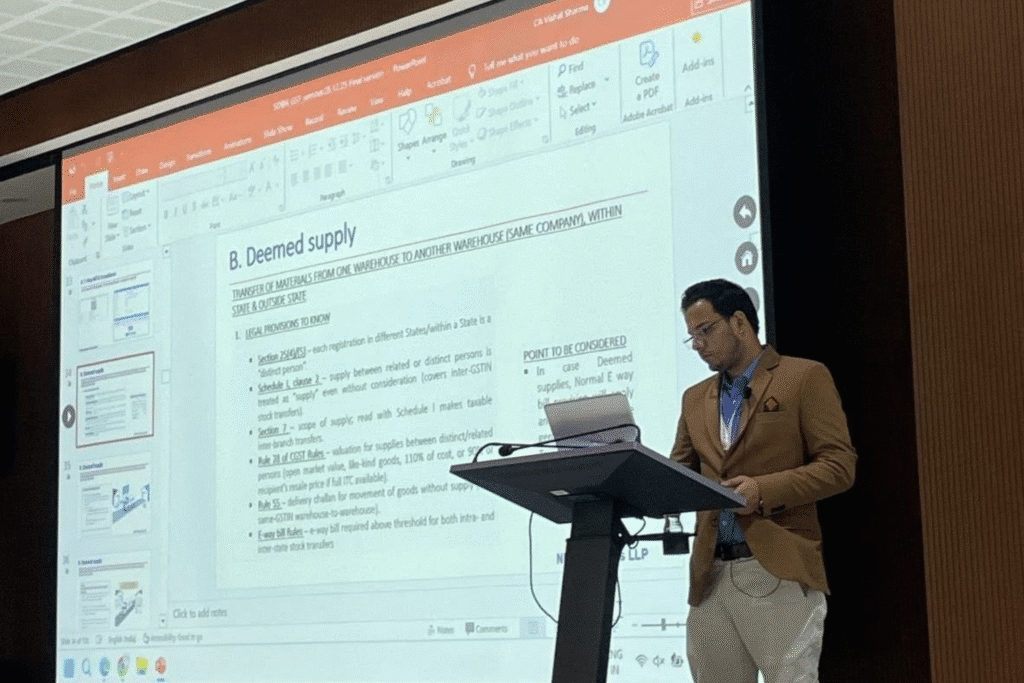

🎓 𝗧𝗵𝗼𝘂𝗴𝗵𝘁 𝗟𝗲𝗮𝗱𝗲𝗿𝘀𝗵𝗶𝗽 | 𝗚𝗦𝗧 𝗦𝗲𝗺𝗶𝗻𝗮𝗿

As part of its thought leadership initiatives, NDM conducted an interactive training session on E-Way Bill compliances under GST, followed by an engaging Q&A session.

The session, led by our Partners 𝗠𝘂𝗸𝘂𝗹 𝗚𝘂𝗽𝘁𝗮 and 𝗩𝗶𝘀𝗵𝗮𝗹 𝗦𝗵𝗮𝗿𝗺𝗮 along with team members 𝗙𝗮𝗶𝗲𝗾 𝗔𝗹𝗶 and 𝗠𝗮𝘆𝗮𝗻𝗸 𝗥𝗮𝘄𝗮𝘁, focused on e-way bill compliances and regulatory aspects, including:

• Applicability and legal framework of E-Way Bills;

• Common compliance gaps and practical challenges;

• Key litigation trends and enforcement issues;

• Best practices to strengthen compliance and monitoring

The interactive discussions and Q&A enabled meaningful exchange of perspectives and practical insights. Through such engagements, NDM continues to support the global MNCs with effective compliance administration and litigation management.

📢 At NDM Advisors LLP, our pre-Diwali celebration beautifully reflected the values that define us - teamwork, positivity, and the spirit of continuous growth. ✨

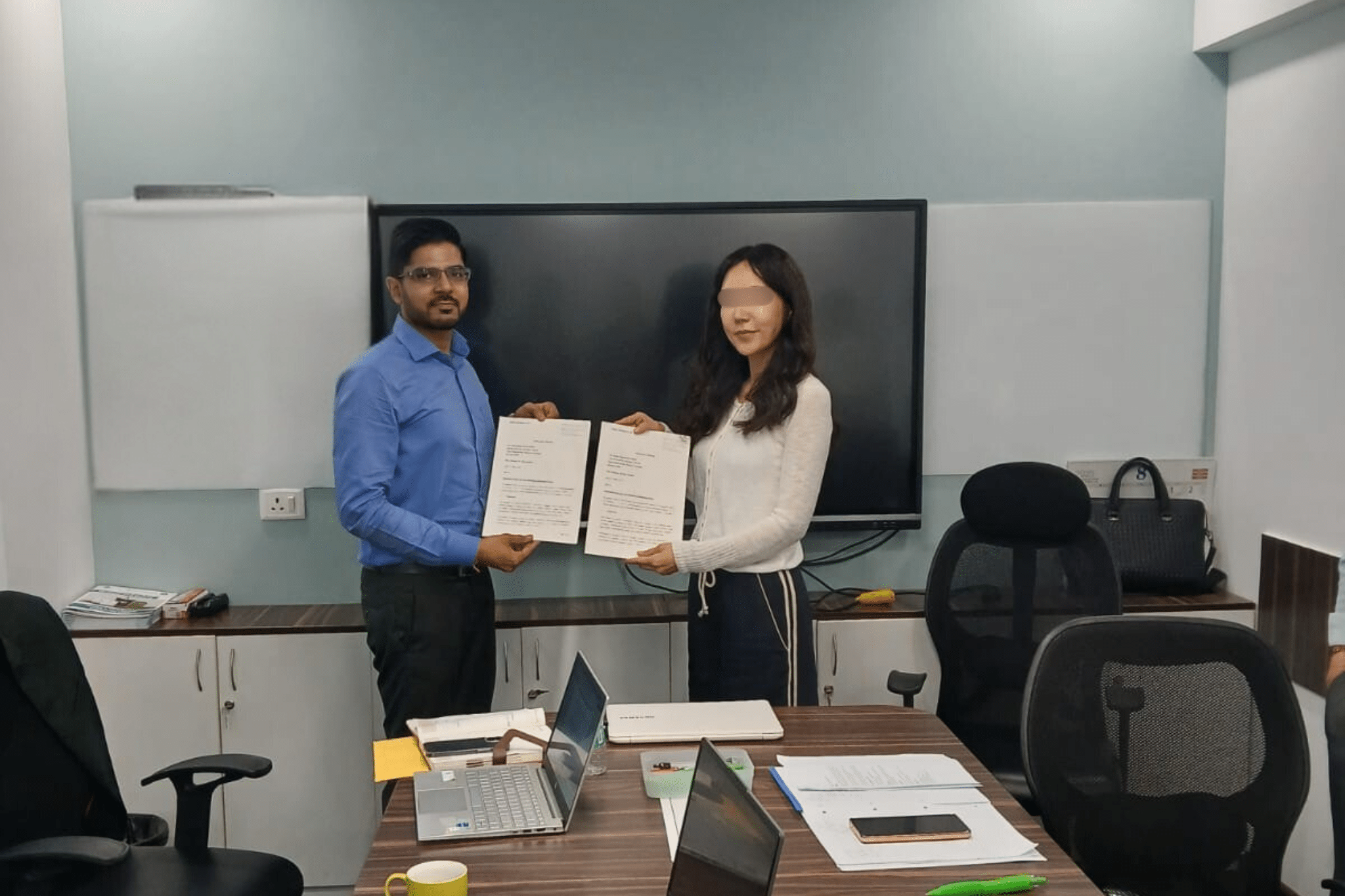

Celebrating Progress: NDM Receives Client Appreciation for Exemplary Cross-Border Solutions

NDM successfully assisted a prominent Korean FMCG company on smooth market entry and FDI compliances in India. The CFO’s gesture of presenting a token of appreciation reflects the satisfaction and happiness of clients who have experienced NDM’s commitment to high-quality service, transparency, and prompt support. The engagement brought out well-structured business operations, risk mitigation, and efficient cross-cultural communication, demonstrating NDM’s value to global enterprises seeking reliable local expertise.

NDM Advisors Signs MoU with International Lifestyle Brand Entering the Indian Market

NDM is pleased to announce the signing of a Memorandum of Understanding (MoU) with a leading global lifestyle brand for the provision of professional advisory services in India.

The engagement marks a significant milestone as the international brand embarks on its entry into the dynamic Indian market. Under the MoU, NDM will provide a comprehensive suite of professional services covering Indian market research, stakeholder relations, regulatory, tax, and compliance requirements to ensure a smooth and structured market entry.

NDM is committed to supporting global businesses in navigating the complexities of the Indian business environment. With deep domain expertise, industry insight, and a client-focused approach, NDM is well-positioned to assist international companies in establishing and expanding their presence in India.

NDM Advisors Assists Leading Korean Conglomerate with IFRS Convergence

NDM Advisors is proud to have assisted a leading Korean conglomerate in its IFRS convergence and allied regulatory support in India. This engagement highlights our commitment to delivering seamless, multidisciplinary solutions that address the evolving needs of global businesses operating in India.

Our expertise across Assurance, Direct Tax, GST, and Regulatory matters enables us to remain the preferred choice for multinational corporations seeking reliable advisory and compliance support.

In the image:

- Mukul Gupta – Founding Partner

- Manish Kukreti – Partner, Direct Tax

- Ankur Jain – Partner, Assurance & IFRS

- Ishita Tiwari – Partner, Regulatory

- Vishal Sharma – Partner, GST

At NDM Advisors, we take pride in being the trusted partner for global companies navigating complex financial and regulatory landscapes in India.

📢 Our partner Nikhil Gupta inspired young changemakers as a speaker at the “INCOC Professional Youth for Viksit Bharat 2025,” igniting a vision for a progressive India.

📢 Our partner took the stage at NACIN, sharing deep insights on regulatory trends and shaping the conversation on compliance and governance. It was an engaging session that sparked dialogue and inspired future leaders in the field.

📢 Moments to cherish and memories to build — our Rishikesh retreat was a perfect blend of adventure, reflection, and team spirit. From soulful Ganga Aarti to fearless rafting, the NDM team came back recharged and inspired!

📢 The spirit of Diwali lit up our office with joy, wisdom, and laughter as Team NDM came together for a heart warming celebration of togetherness and light.

📢 We’re pleased to share that our partner Mukul Gupta recently led a training session for Haryana State GST Officials at NACIN, Faridabad, offering in-depth insights on GST Audit, Assessment, and key reconciliation strategies.

📢 Our partner Nikhil Gupta conducted a training session on GST Audit and Assessment for Haryana State GST Officials at NACIN, Faridabad, sharing key strategies and best practices.

📢 NDM conducted a training session for EPFO officers under the Ministry of Labour, where our partner Nikhil Gupta led an insightful discussion on labour laws, compliance, and financial audit nuances.

📢 ICAI Enjoyed discussion with industry reps, practising CAs, govt nominees and esteemed Panelist Dr. Ravi Gupta, Gaurav Garg, Avinash Gupta, Balwan Bansal, Gagan Makkar and Ajay Singhal

📢 NDM Team accepting the ‘Rising Star in Taxation’ award at 12th Edition Tax Strategy and Planning Summit 2025 "organised by UBS Forums"

📢 NDM Successfully assisted a large Korean Company with their India Incorporation and licensing support services

📢 NDM Training Update | NACIN

We are pleased to announce that NDM recently delivered another impactful training session for Haryana State GST Officials, hosted by the National Academy for Customs, Indirect Taxes, and Narcotics (NACIN).

Our Partner, Mukul Gupta, led discussions on key regulatory and litigation areas, covering:

🔹 Corporate Compliances under Foreign Exchange Regulations.

🔹 Critical issues in GST and Customs Litigation.

🔹 Financial Statement Analysis to identify disallowable and blocked credits under GST.

As regulatory scrutiny intensifies, such knowledge-sharing sessions enable smoother compliance and sharper enforcement by tax officials. We are proud to support the continued development of India’s tax and regulatory ecosystem.