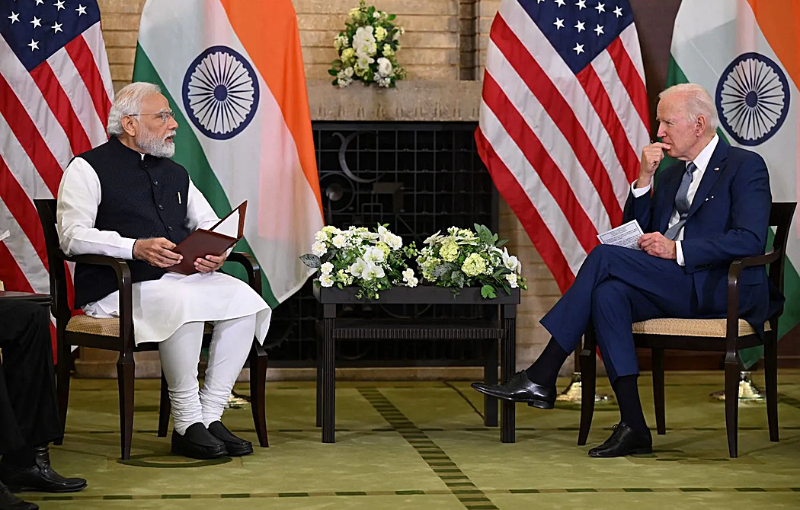

DTAA Between India and USA

1) TDS ON PAYMENTS TO NON-RESIDENTS (Section 195)-

Any person responsible for paying any sum to a non-resident, which is chargeable to tax under the Income Tax Act shall at the time of payment deduct tax at source at the rates in force.

Rates in force: (Section 2(37A) + Section 90(2))

- Rate specified in the relevant Finance Act (or)

- Rates specified in DTAA

Whichever is beneficial to the assessee.

2) DTAA BETWEEN INDIA AND USA-

ARTICLE 12: ROYALTIES AND FEES FOR TECHNICAL SERVICES

Royalties and fees for technical services arising in India and paid to a resident of USA may be taxed in India at a rate not exceeding-

during the first five taxable years for which this Convention has effect,

- 15 per cent of the gross amount of the royalties or fees for included services, where the payer of the royalties or fees is the Government of USA, a political sub-division or a public sector company ; and

- 20 per cent of the gross amount of the royalties or fees for included services in all other cases ; and during the subsequent years,

- 15 per cent of the gross amount of royalties or fees for included services ; and in the case of royalties that are ancillary and subsidiary to the enjoyment of the property for which payment is received ,

- 10 per cent of the gross amount of the royalties or fees for included services.

3) CREDIT OF TAX BORNE BY NON-RESIDENT-

ARTICLE 23: ELIMINATION OF DOUBLE TAXATION

Where a resident of USA derives income from India which may be taxed in India in accordance with the provisions of DTAA, the amount of Indian tax payable in respect of that income shall be allowed as a credit against the United States tax imposed on that resident.

In case of queries, drop us a line on communications@ndm.net.in

Have Any Question?

Send us a message and tell us more about your business and financial goals. We will get back to you soon to schedule a consultation.

- +91 9873210394

- Communications@ndm.net.in