Investment Management Reporting Software

Below mentioned are some of the salient features of our internal support software:-

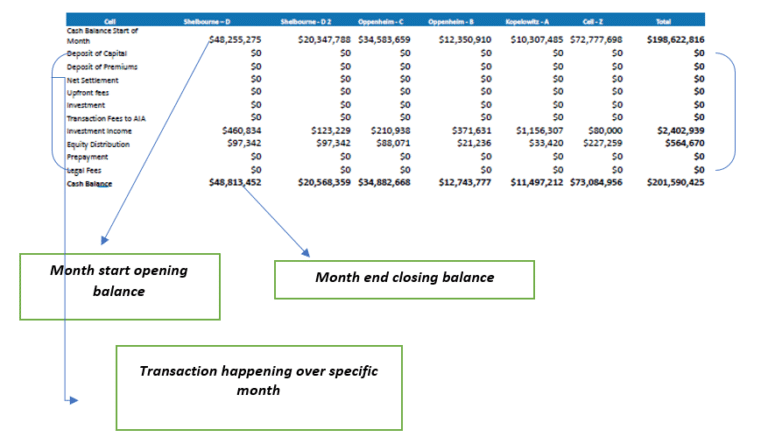

Monthly Activity:-

It reports the opening month balance followed by actual inflows/ outflows taking place in that particular month as of date of generating this report, and finally shows actual available funds as of date.

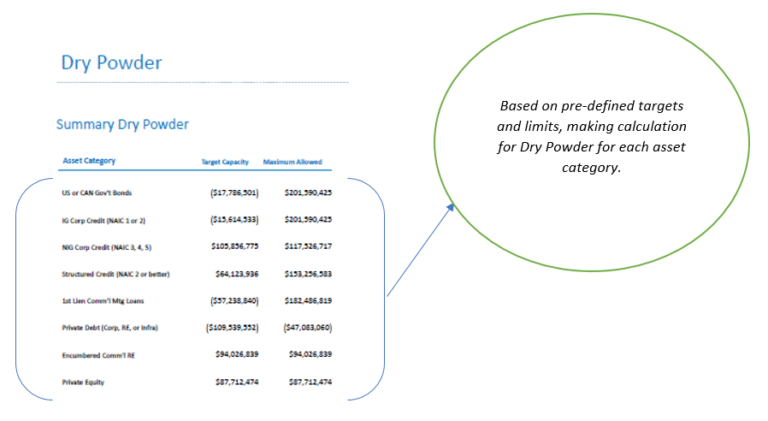

Dry Powder Reporting

Dry powder refers to cash reserves that corporations and private equity funds have available to deploy when an attractive investment opportunity arises or to weather a downturn. The cash reserves give their holders an advantage over other firms that do not keep reserves since they can be used to capitalize on opportunities or to help them meet debt obligations when they come due. Most organizations, especially venture capitalists and private equity funds, maintain a dry powder in anticipation of tough economic times.

In other words, Dry Powder refers to the deployable funds available with the organisation. It is also a parameter that shows investment preparedness of a fund management house.

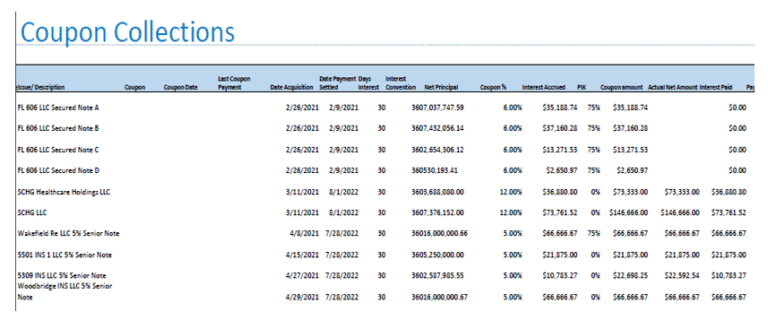

Expected Coupon Collection:

It is critical to track the incoming coupons which are expected to be received for the subsequent months and to track the same against the actual receipts. The same reflects the amount of interest which is receivable for each assets holding, and it is generated in advance for the upcoming month.

Benefits of the above report:

- The same is made to identify the actual inflows which is going to be received in that particular month for which this report is generated.

Used for distributing out to asset managers the pendency as a gentle reminder for making the remittance.

Generating expected coupon reports at the start of every month for each asset holding which are due to be received in the month and tracking it down till the time it gets received.

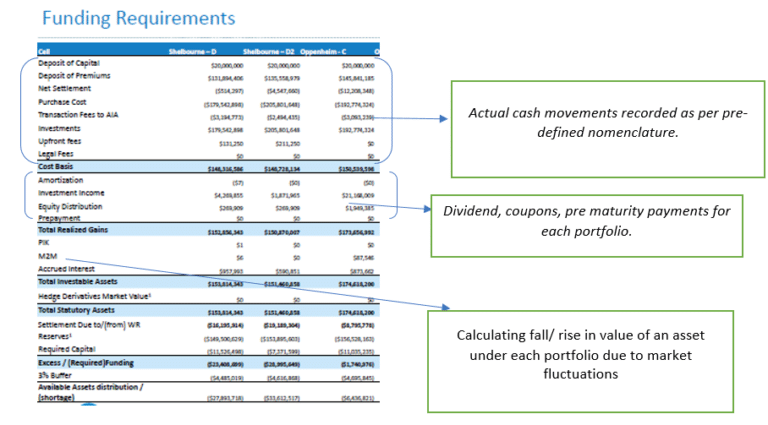

Funding Requirement Schedule

It is critical to keep a check on the funding available with the investment houses as required in order to meet the short-term outflow requirements. In an unlikely event, there is possibility that the fund manager might run out of liquid funds and default in the payment obligations. Therefore, it is critical to track funding requirement as per statutory liquidity norms and internally set parameters. This report is prepared by summarizing all the required information pertaining to inflows and outflows required for decision-making by portfolio managers.

PIK BONDS

A payment-in-kind (PIK) bond refers to a type of bond that pays interest in additional bonds rather than in cash during the initial period. The bond issuer incurs additional debt to create the new bonds for the interest payments. Payment-in-kind bonds are considered a type of deferred coupon bond since there are no cash interest payments during the bond’s term.

Amortization Loans

Amortization can refer to the process of paying off debt over time in regular installments of interest and principal sufficient to repay the loan in full by its maturity date. A higher percentage of the flat monthly payment goes toward interest early in the loan, but with each subsequent payment, a greater percentage of it goes toward the loan’s principal.

Integrating an amortization calculator to assure the right position is reflected of such assets in reports.

M2M

Mark to market (MTM) is a method of measuring the fair value of accounts that can fluctuate over time, such as assets and liabilities. Mark-to-market aims to provide a realistic appraisal of an institution’s or company’s current financial situation based on current market conditions.

Checking down the value of each asset on a day-to-day basis for tracking the above.

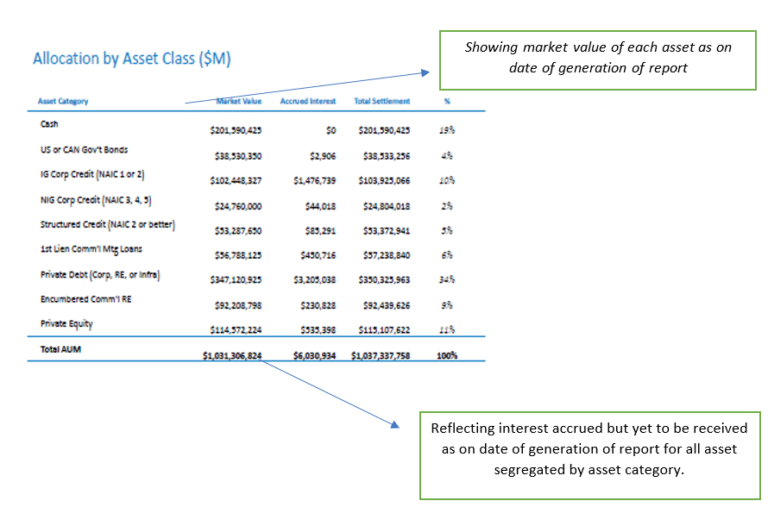

Allocation by Asset class

This schedule helps in identifying asset holdings by their asset class, along with that, it shows the market value and accrued interest which are yet to be received calculated from the previous date of payment.

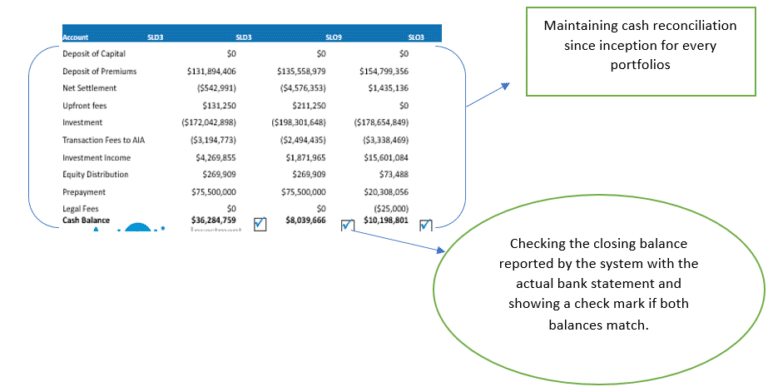

Cash Reconciliation

The following report helps in knowing if transactions booked in the system are in line with actual events and checks if there is any leak of invested funds.

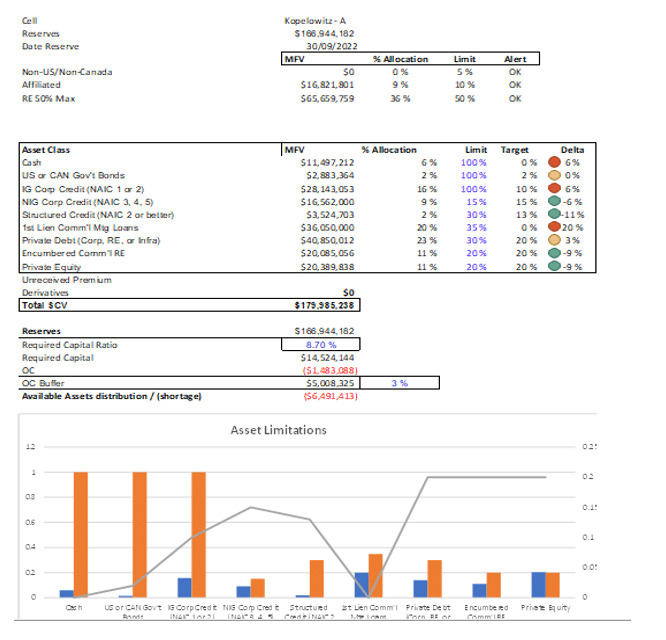

Portfolio Trackers

A portfolio tracker is a tool that has been put in place so that investors may keep a track of how well their scrips are doing at a given point of time. In short it serves as a snapshot of the holdings that an investor has.

A portfolio tracker has several advantages to offer. It reveals data on:

- The gain-losses statements of an investor through the buy/sell trades that he has made

- The holdings of the investor at a particular point of time

- The transaction statements and

- The updated prices of stocks

Apart from this the portfolio tracker also gives the investor details on the split up of his holdings in terms of sectors and the percentage composition (sectoral) that he has allocated in his total portfolio.

The stocks reflected in the portfolio tracker are those that are there in the Demat account of the customer. Hence any stock that has been bought/sold by the investor would get reflected after T+1 days

Generating portfolio trackers showing all the assets listed under a portfolio along with requiste data that are required for circulating to investors.

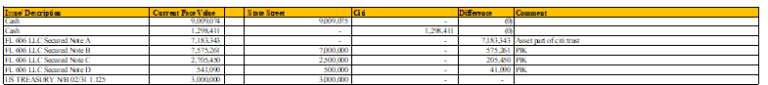

Position reconciliation

Position Reconciliation is basically verifying positions as of any particular date against external parties like custodians, counterparties, etc. The reconciliation process ensures each trade is verified and validated accurately, hence ensuring the right impact on the P&L and Balance sheet.

Reporting Asset wise comparisons for the system-generated report and custodian reports for easy working on the cause of differences between the data.

Have Any Question?

Send us a message and tell us more about your business and financial goals. We will get back to you soon to schedule a consultation.

- +91 9873210394

- Communications@ndm.net.in