Understanding Difference Between ESOP and PSOP

In 2021, the ESOPs buyback by Indian startups was close to $450 million which is the highest to date for India. This shows that ESOPs are starting to become a popular choice for startups and are being welcomed by employees. Indian companies have spent close to Rs 2,500-3,000 crores a year to buy back ESOPs during the pandemic. Various studies indicate that capital-sharing arrangements, such as ESOPs, might make employees feel more encouraged and happy,

leading them to be motivated to work and stay with the company long term than they would otherwise. Employee stock ownership plans (ESOPs) have emerged as the tool to attract and retain talent across all levels of employees with an increasing number of startups offering this option and announcing buybacks in the recent past.

‘Employee Stock Option’ (ESOP) has been defined under Section 2(37) of the Companies Act, 2013, according to which “employees’ stock option” means the option given to the directors, officers or employees of a company or of its holding company or subsidiary company or companies, if any, which gives such directors, officers or employees, the benefit or right to purchase, or to subscribe for, the shares of the company at a future date at a predetermined price.

An employee stock ownership plan (ESOP) is an employee benefit plan that gives workers ownership interest in the company in the form of shares of stock. ESOPs encourage employees to give their all as the company’s success translates into financial rewards. They also help staff to feel more appreciated and better compensated for the work they do.

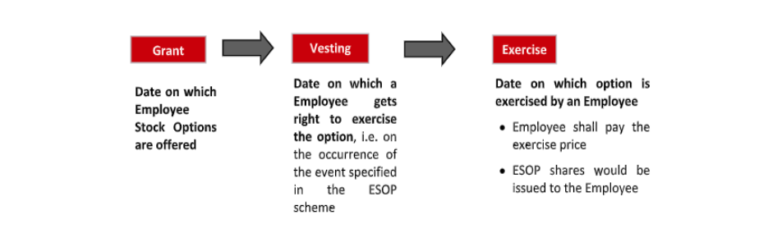

Companies typically tie distributions from the plan to vesting, which gives employees rights to employer-provided assets over time. Other versions of employee ownership include direct-purchase programs, stock options, restricted stock, phantom stock, and stock appreciation rights. Consider an employee who has worked at a large tech firm for five years. Under the company’s ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.

Stock ownership plans may include stock options, restricted shares, and stock appreciation rights, among others.

A phantom stock plan is an employee benefit plan that gives selected employees (senior management) many of the benefits of stock ownership without actually giving them any company stock. This type of plan is sometimes referred to as shadow stock. Rather than getting physical stock, the employee receives mock stock. Even though it’s not real, the phantom stock follows the price movement of the company’s actual stock, paying out any resulting profits.

A phantom stock plan, or ‘shadow stock’ is a form of compensation offered to upper management that confers the benefits of owning company stock without the actual ownership or transfer of any shares. Large cash payments to employees, however, must be taxed as ordinary income rather than capital gains to the recipient and may disrupt the firm’s cash flow in some cases. There are two main types of phantom stock plans.

“Appreciation only” plans do not include the value of the actual underlying shares themselves, and may only pay out the value of any increase in the company stock price over a certain period of time that begins on the date the plan is granted.

“Full value” plans pay both the value of the underlying stock as well as any appreciation.

Some organisations may use phantom stock as an incentive to upper management. Phantom stock ties a financial gain directly to a company performance metric. It can also be used selectively as a reward or a bonus to employees who meet certain criteria. Phantom stock can be provided to every employee, either across the board or distributed variable depending on performance, seniority, or other factors.

One of the lesser known reasons why founders may prefer PSOPs as compared to ESOPs is that PSOP grantees do not sit on your cap table. A higher number of existing shareholders at the time of investment can make things really difficult to coordinate. Imagine a situation where you have about 15 employees who were granted employee stock options at the same time (this is not recommended by the way, when you are at a very early stage in the business). If all of them exercise their options after two years, all of a sudden, you will have 15 shareholders in addition to the promoters. Let’s say you negotiated an investment and now need to sign a Shareholders Agreement in year 3. Now you will need signatures from all existing shareholders (unless you have been smart enough to nominate a POA / Trustee). Two or three of these employees might have moved on and even settled in another country, making life difficult for you.

This is why ESOP plans would need to be drafted with a lot of care, thinking about all such eventualities. As against this, PSOPs can give a lot of flexibility to incentivise employees without having to meet a lot of formal and coordination requirements.

Have Any Question?

Send us a message and tell us more about your business and financial goals. We will get back to you soon to schedule a consultation.

- +91 9873210394

- Communications@ndm.net.in